philadelphia property tax rate 2022

For example Chester County has one of the highest average annual tax rates at 4192 while the average in. Only property owners whose values change will receive notifications.

Socked By The Pandemic Kenney Administration Forgoes Property Reassessments For Second Year In A Row Pennsylvania Capital Star

Ad Research Is the First Step to Lowering Your Property Taxes.

. The proposed tax rate for fiscal year 2022 is 1489. Philadelphia Property Taxes Range. Property taxes rates vary depending on the locality or county where a home is located.

Paying your Philly property tax online is always best. Get information about property ownership value and physical characteristics. While the citys property tax rate has not changed in the last few years some property owners have had significant tax increases due to changing assessments.

Mayor Jim Kenneys administration isnt reassessing all properties for tax years 2021 or 2022 instead giving the citys Office of Property Assessment time to implement a long-awaited new computer system make. Governor Tom Wolf has announced that the 2022 Open Enrollment Period for health care coverage through Pennie Pennsylvanias state-based health insurance marketplace has begun. Non-residents dont pay the.

Use the Property App to get information about a propertys ownership sales history value and physical characteristics. Those property owners will receive notice of their assessments by March 31 and their new values will take effect for taxes in 2022. Frequently Asked Questions Authored By.

As of July 1 2021 the rate for residents will be 38398. 2022 average tax bill. The city of Philadelphia assesses property at its current market value.

You can also generate address listings near a property or within an area of interest. Based on latest data from the US Census Bureau. January 27 2022 at 456 pm.

EASTTOWN At its meeting on January 24 2022 the Tredyffrin-Easttown Board of School Directors adopted a resolution limiting any increase in property taxes for. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. Pennsylvania is ranked 1120th of the 3143 counties in the United States.

There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools. 2022 average tax bill. Philadelphia property owners are enjoying a two-year reprieve from reassessments and the tax hikes that often follow.

For the 2022 tax year the rates are. February 1 2022 at 946 am. Average Property Tax Rate in Philadelphia.

Community Legal Services of Philadelphia. Please use this website for the current Real Estate Tax balances due on. The School Income Tax rate is also changing.

After that date this tax will be added to the Philadelphia Tax Center. Change in tax bill. DOWNINGTOWN The recovery from Ida continues.

The storm struck the Greater Philadelphia Region 21 weeks ago. 2021 average tax bill. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

LIHEAP for 2021-2022 is now open. Tax information for owners of property located in Philadelphia including tax rates due dates and applicable discounts. Find more information about Philadelphia Real Estate Tax including information about discount and assistance programs.

All other design information text graphics images pages interfaces links software and other items and materials contained in or displayed on this site and the selection and arrangements thereof are the property of the City of Philadelphia. Tax Year 2022 assessments will be certified by OPA by March 31 2021. Enter Your Address to Begin.

Browse Current and Historical Documents Including County Property Assessments Taxes. How often are property taxes paid in Philadelphia. According to a more exact calculation the countys average effective property tax rate is 099 percent compared to the states average effective property tax rate of 150 percent.

Continue to use our balance search website to pay your Real Estate Tax until October 2022. Read the School Income Tax regulations for a full list of taxable income types. Philadelphia Property Taxes Range.

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA. If you are a resident of Philadelphia who receives certain types of unearned income such as royalties rental income this tax applies to you. Ultimate Philadelphia Real Property Tax Guide for 2022.

Bills reflecting those assessments will be issued in December of 2021 for taxes due in March of 2022. 14012022 Helen McDowell. Yearly median tax in Philadelphia County.

Property tax in Philadelphia County is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax exemptions would pay. 091 of home value. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT.

For questions about your account email revenuephilagov or call 215 686-6442. By phone by calling 877 309-3710. January 26 2022 at 1112 am.

The fiscal year 2021 rate was also 1489 The city expects to get 1860518 in revenue from the tax levy which is a 414 increase from the.

Real Estate Living On Twitter Real Estate Agent Real Estate Career Real Estate Tips

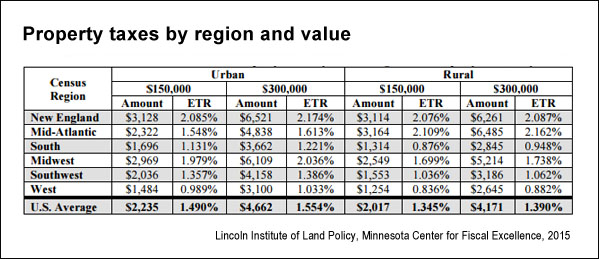

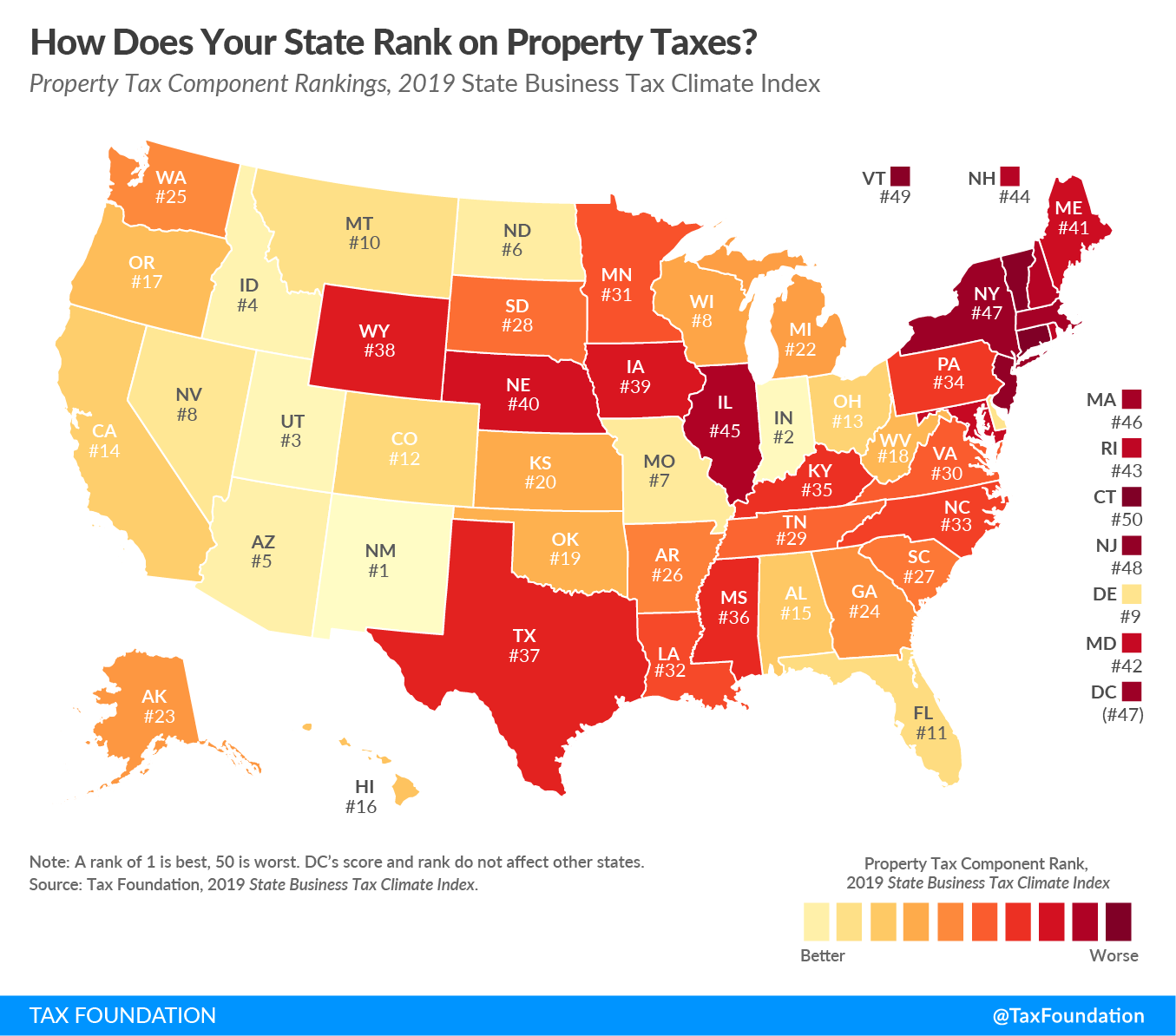

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

Philadelphia County Pa Property Tax Search And Records Propertyshark

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Lawrence Welk Resort Villas Timeshare Escondido California San Diego 19 00 Usd Polybull In 2022 Timeshare Vacation Village Kissimmee

Pin On Semiotics November 2020

Philadelphia County Pa Property Tax Search And Records Propertyshark

Philadelphia County Pa Property Tax Search And Records Propertyshark

Philadelphia County Pa Property Tax Search And Records Propertyshark

Business Property Tax The Ultimate Guide

Pennsylvania Property Tax Calculator Smartasset

Soaring Home Values Mean Higher Property Taxes

Pennsylvania Property Tax H R Block

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource